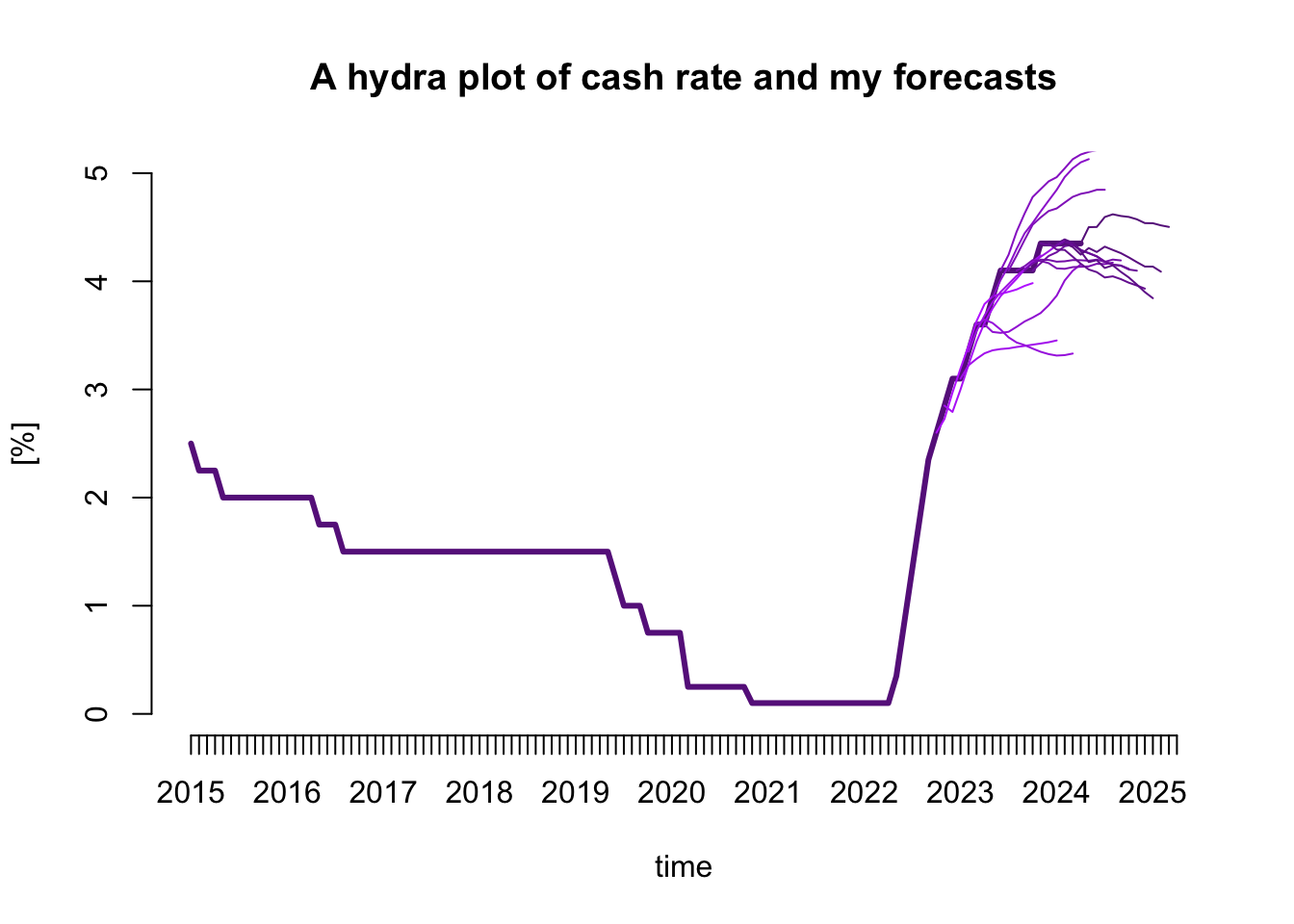

Rba Cash Rate Forecast 2025. The median forecast from economists surveyed by bloomberg predicts the rba will lower the cash rate three times in 2025 to 3.6 per cent, with 0.25 percentage point rate cuts pencilled in. commonwealth bank is the most optimistic of the big four banks.

This would take the official cash rate to 3.60%, which is close to the middle of the rba’s neutral rate. The rba will be under major pressure in 2025 to provide some mortgage relief to struggling aussies.

Australia Interest Rate Forecast For Next 5 Years, Aap) millions of homeowners will be hoping the trend of the.

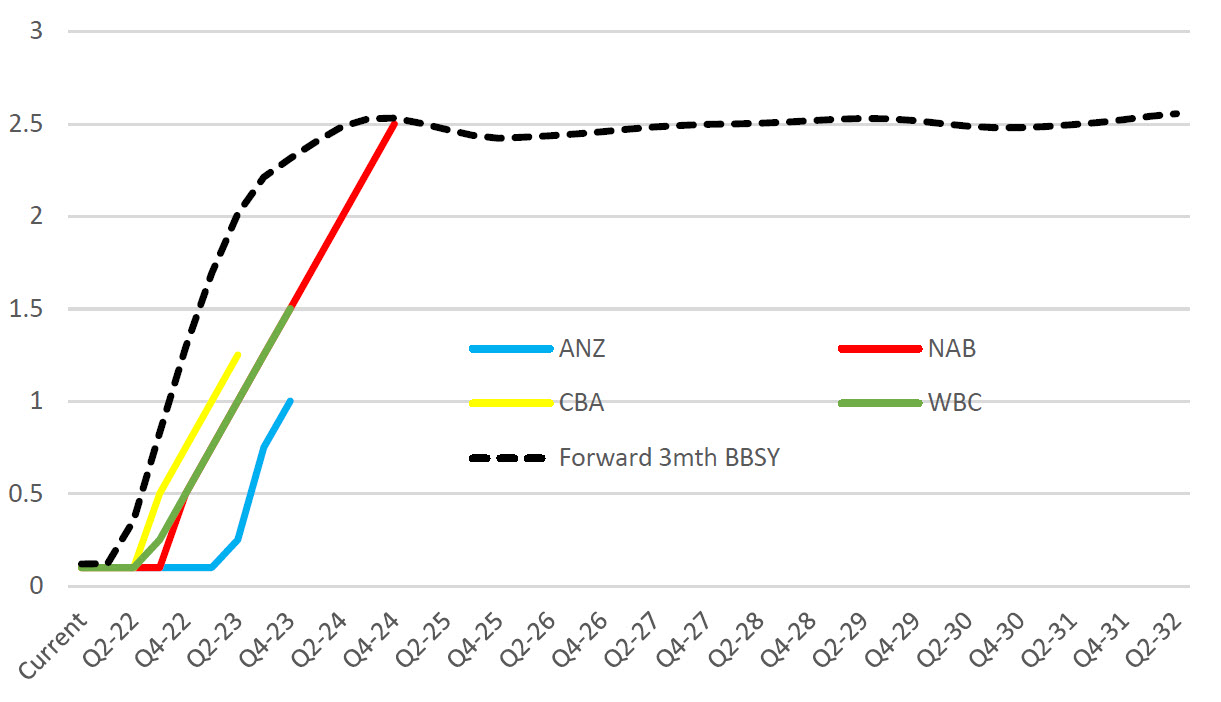

How the RBA cash rate forecast changed + latest CBA forecast on one, This would take the official cash rate to 3.60%, which is close to the middle of the rba’s neutral rate.

Lending Rates on the Rise Despite Cash Rate Unchanged Ledge Finance, Bond traders now expect at least three interest rate cuts from the rba during 2025.

The RBA raised rates in March and May despite its own analysis saying, First published 8 jan 2025, 11:21am.

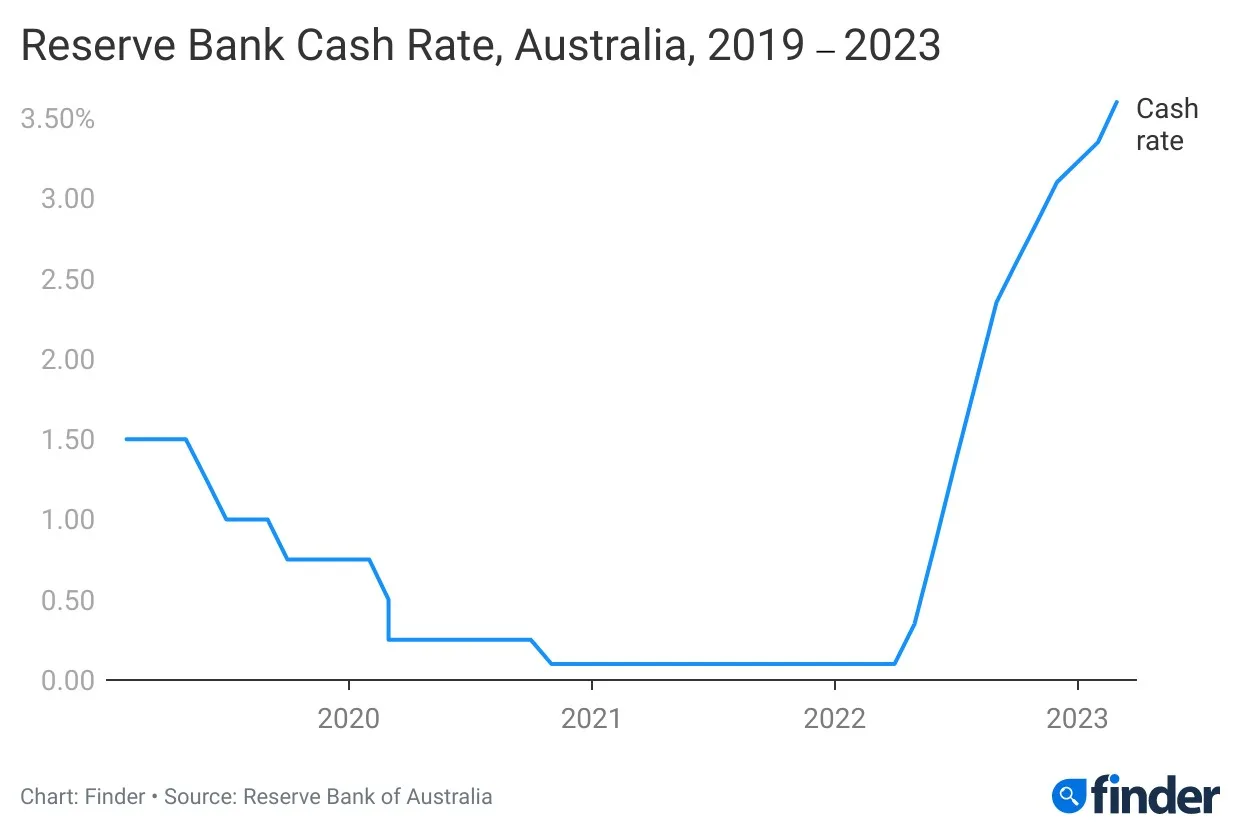

RBA's 10th rate hike hits Can you afford another mortgage rate rise, After more than a year of the reserve bank of australia (rba) keeping its cash rate target on hold at 4.35 per cent, forecasts are for at least one 0.25 of a percentage point cut in 2025.

Cash Rate Decision February 2025 RBA Raises Cash Rate To 3.35, After more than a year of the reserve bank of australia (rba) keeping its cash rate target on hold at 4.35 per cent, forecasts are for at least one 0.25 of a percentage point cut in 2025.

Forecasting cash rate RBA Cash Rate Survey Forecasts, Bringing the cash rate to today's 4.35%.

Economic Outlook Statement on Policy May 2025 RBA, The path for the cash rate reflects expectations derived from surveys of professional economists and financial market pricing, with an assumed peak in the cash rate of around 4¼ per cent by the end of 2025 before declining to 3¼.

Why the RBA won't hike rates again MacroBusiness, The rba will be under major pressure in 2025 to provide some mortgage relief to struggling aussies.