Roth Contribution Limit 2025. This figure is up from the 2025 limit of $6,500. For 2025, the ira contribution limits are.

This is a combined contribution limit for all of your ira. You have until april 15, 2025 to stash away.

Roth IRA Contribution and Limits 2025/2025 TIME Stamped, If you are 50 or. Limits on roth ira contributions based on modified agi.

IRA Contribution Limits in 2025 Meld Financial, Not fdic insured • no bank guarantee • may lose value the charles schwab corporation provides a full. The account owner must be under the annual income limit for roth ira contributions.

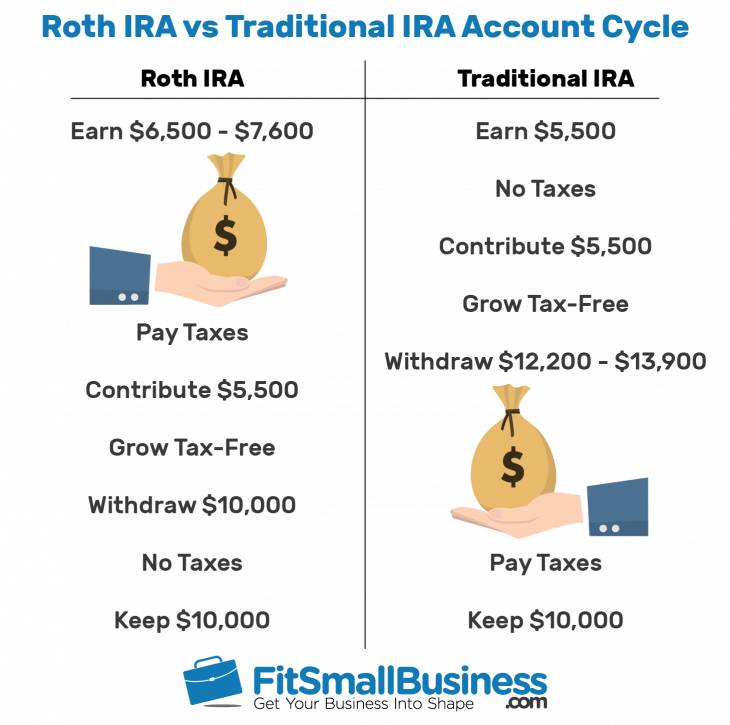

401k 2025 Contribution Limit Chart, Your roth ira contribution might be limited based on your filing status and income. The ira contribution limits for 2025 are $6,500 for those under age 50 and $7,500 for those 50 and older.

What is a Roth IRA? The Fancy Accountant, This figure is up from the 2025 limit of $6,500. The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

Roth ira eligibility calculator ArmandCarmela, 12 rows if you file taxes as a single person, your modified adjusted gross income. Individual retirement accounts (iras) are a common source of.

Roth IRA Rules, Contribution Limits & Deadlines Best Practice in HR, The irs has announced the increased roth ira contribution limits for the 2025 tax year. The maximum contribution limit for roth and traditional iras for 2025 is:

Roth IRA Contribution Limits 401(k) Plan Finance Strategists, You can boost your retirement savings in just a few steps. If your income was under the threshold last year, you are eligible to make direct contributions to a roth ira.

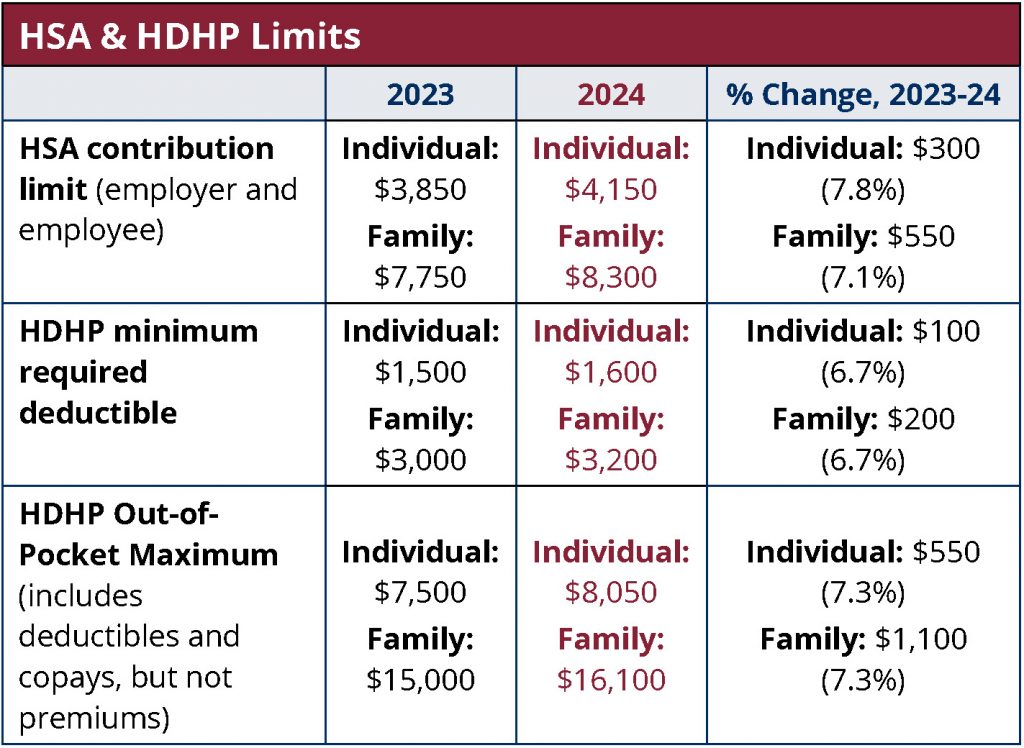

2025 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, HSA, This is a combined contribution limit for all of your ira. You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2025.

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government's. 2025 roth ira income limits.

Roth IRA Contribution Limits Medicare Life Health 2019 & 2025 Rules, Limits on roth ira contributions based on modified agi. For 2025, the ira contribution limit is $7,000.

If your income was under the threshold last year, you are eligible to make direct contributions to a roth ira.

The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government's.